Part I of this post looked at how silicon carbide (SiC), one of the primary compound semiconductors for power applications, is being implemented to optimize a wide range of environmentally sensitive end markets, from EVs and rail transport to solar and wind energy. In Part II, we will take a similar look at the key end markets for gallium nitride (GaN).

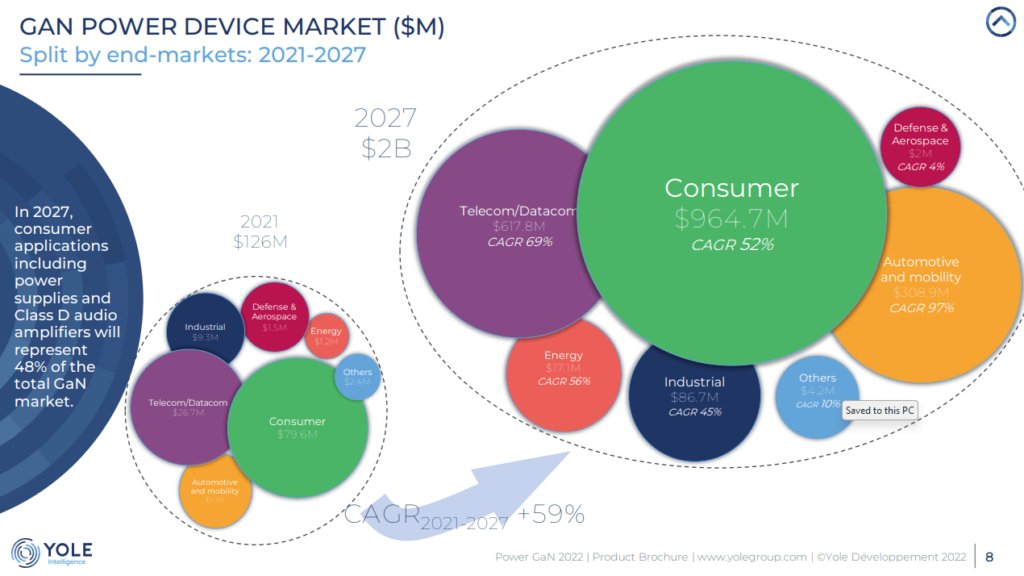

According to the “Power GaN 2022” report issued by the Yole Group, the GaN market is expected to reach $2 billion in 2027 (Figure 2). In 2021, many companies doubled or even tripled their revenue from GaN components, resulting in a 138% increase in the total revenue of the component market compared to 2020.

Figure 1. The GaN power device market ($M) split by end-markets: 2021~2027 (Yole Group data)

Consumer power

As of 2022, more and more fast chargers with >100W power are being used in smartphones with larger screens and more power-hungry functions. Fast charging is still growing rapidly in the mobile phone market, with GaN content increasing in power factor correction (PFC) circuits needed for fast chargers. For non-handset applications, strong penetration of GaN in the notebook market above 65W is expected to bring numerous advantages. Apple first adopted GaN for the MacBook 140W standard charger in the fourth quarter of 2021. Other applications where GaN will slowly penetrate include TV power supplies, power tool chargers, and home appliances. The GaN consumer power supply market will become the main driving force, and the industry scale will exceed US$915.6 million by 2027, with a compound annual growth rate (CAGR) of 52% from 2021 to 2027.

Datacom and telecom power

GaN penetration will increase as regulations, such as the EU Lot 9 requirements for material efficiency, become more stringent. These regulations will drive power suppliers to look for alternatives to silicon-based systems. At power levels of a few kilowatts, discrete GaN components are expected to dominate. The use of 48V systems in data centers to reduce power consumption and wiring volume is beneficial for GaN for low-voltage applications. More and more power suppliers are adopting GaN in the system. Transphorm, EPC, Texas Instruments, Infineon and GaN Systems have all announced multiple design solutions. The output value of the GaN data communication and telecom power supply market in 2021 was $US26.7 million. The CAGR from 2021 to 2027 is expected to reach 69%, with the market size exceeding $US617.8 million by 2027.

Industry

GaN is attractive for use in power supplies, allowing for size reduction and higher efficiency. The material also holds potential in motor drives and high-switching-speed precision tool applications, where compactness is required. However, the industrial market is highly conservative, and many customers are satisfied with “good enough” silicon solutions. GaN penetration is therefore expected to be low in the short to medium term. In the long run, GaN may have a stronger penetration rate in the industrial market as costs fall; it may first enter the sub-1kW power range market, and then slowly migrate to higher power.

Vehicles

In the EV/HEV market, GaN will compete with silicon and SiC. Currently, we are seeing several instances of GaN devices being used in small-power applications such as on-board chargers (OBCs) and DC/DC conversion. For OBCs, the 3kW to 11kW range is attractive for GaN, and OEMs are increasingly becoming interested in the technology. For DC/DC conversion, GaN is expected to enter the 48V to ~12V bidirectional pass-through converter. Inverters represent the highest-volume opportunity for semiconductor devices.

GaN penetration will depend on the development of high-voltage devices, multilevel systems and performance reliability acceptance, along with price erosion. Vendors such as EPC, Transphorm, GaN Systems and TI have passed AEC certification for their automotive components. From 2024 to 2025, GaN is expected to achieve modest penetration. For e-mobility, the power levels are different than for other transport segments; GaN is expected initially to penetrate high-end electric bicycles and electric motorcycles.

Solar photoelectric

GaN components are well suited for micro-inverter systems and sub-10kW energy storage system (ESS) solutions. Transphorm, GaN Systems and Navitas have received designs in this area. Looking ahead, GaN will achieve moderate penetration in solar photovoltaic applications.

Wireless charging

As more new phones with high-power wireless charging hit the market, GaN has an advantage at higher frequencies, which could be of interest to OEMs. But there are still challenges for high-frequency wireless charging to solve heat generation and design complexity issues, which means that it will take time for GaN to achieve mass adoption in the short to medium term. At this stage, GaN has been minimally adopted by OEMs for proprietary standards to integrate mobile phones and chargers, as well as for drones and other niche applications.

LiDAR

The added value of GaN high-electron mobility transistors (HEMTs) in LiDAR sensing applications lies primarily in the ability to generate very short pulses at high currents (>20A), giving LiDAR systems excellent resolution, faster response time and higher precision compared to silicon MOSFETs. GaN is expected to penetrate this market at Level 3 for automated driver assistance systems (ADAS), challenging silicon MOSFETs. With higher vehicle autonomy, GaN shows a better cost/performance ratio.

Class D audio amplification

Class D amplifiers eliminate distortion and achieve better audio quality than Class AB amplifiers. Class D amplifiers are deployed in high-end audio systems, such as sound reinforcement systems or home theater systems. GaN offers an excellent figure of merit in terms of sound quality, efficiency and form factor. GaN Systems, EPC, and Infineon have launched solutions, and all have design experience in high-end, high-performance audio amplifiers.

Supply chain

At the component level, there are new players entering the market. ROHM is providing 150V GaN products for telecom/datacom applications; STMicroelectronics is expanding its product portfolio with the STPOWER series; and Power Integrations continues to advance in the GaN market for fast charger applications. Navitas and Innoscience have also received multiple product orders from smartphone manufacturers. EPC, focused on low-voltage GaN components, has won designs in Class-D audio applications and continues to penetrate the industrial market. Meanwhile, GaN Systems has gained designs in consumer power supplies, notably Apple’s MacBook chargers.

It is worth noting that Innoscience continues to gain a number of design introductions in the Chinese consumer market. The IDM plans to expand its 8-inch wafer production from 10,000 units to 70,000 units by 2025. GaN power manufacturers’ business has grown rapidly, and the annual growth rate of the GaN power market has reached 138%. Consumer applications such as fast charging will still drive the GaN power industry, so we expect to see more new players, mainly from China.

Technology and cost

The mainstream platform continues to be 6-inch GaN-on-Si. According to System Plus Consulting, epitaxy accounts for 30% to ~40% of the cost of GaN components. Some manufacturers already have 8-inch fabs or plan to switch to 8-inch in the next few years. The advantages are increased capacity at the component level and reduced cost. On the other hand, GaN epitaxy and processes are technically challenging in terms of uniformity, bow and warpage, and yield loss.

Reliability is one of the main challenges in applications with long replacement cycles such as industrial and automotive. Consumer applications have become the first step for new players to enter the market. JEDEC standards and AEC Q101 automotive certification are indispensable as standards and guidelines for what and how to measure are released. As a new technology, GaN needs to be matched with the package to optimize its performance. Transistor outline (TO) and surface-mount device (SMD) approaches, which can operate at high power and high frequency, have matured and are still improving. Advanced options, including embedded die, wafer-level chip-scale packaging (WLCSP) and land-grid array (LGA)/ball-grid array (BGA) minimize stray inductance for high-frequency operation and package footprint in compact systems. However, due to higher costs, higher-order packaging requires a balance between the performance required for each application.

Conclusion

As this blog series has highlighted, compound semiconductors are playing an increasingly vital role in enabling advancements for many applications that require these materials’ advantages. SiC, GaN and other compound semiconductors’ structure and chemical makeup enables electrons to move much faster in these materials in than in silicon, allowing very high-speed processing. Because these devices operate at lower voltages, this faster processing can be achieved without generating high amounts of heat, making them heat resistant and thus well suited for power-sensitive applications. The green future is here, and compound semiconductors are key to driving it forward.