Compound Semiconductors for a Greener World

With regulations for carbon-neutral and net-zero-carbon emissions officially launched in various countries, energy saving, and carbon reduction are no longer just vague goals but essential aspects of companies’ development strategy. Those with heavy electricity consumption are starting to review their energy-saving and environmental protection-related measures as well. The automobile industry has vigorously promoted the development of electric vehicles (EVs), and renewable and alternative energy sources have gradually become a key player in the power field. Manufacturers of semiconductors and electronic products are also working hard to reduce carbon emissions.

To help the industry achieve these goals and improve the efficiency of power systems, compound semiconductors – especially wide bandgap (WBG) components such as silicon carbide (SiC) and gallium nitride (GaN) – become the key. Part I of this post delves into the power SiC device market, providing snapshots of applications where SiC is influencing market development.

Silicon carbide (SiC)

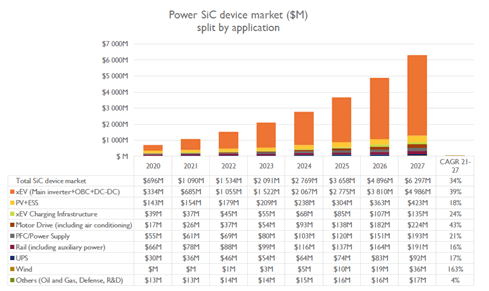

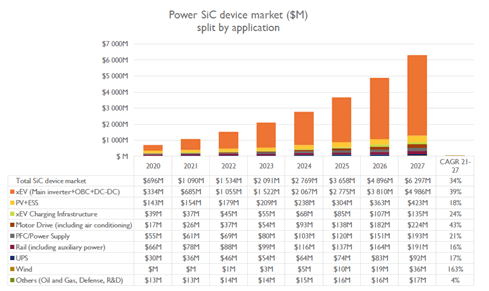

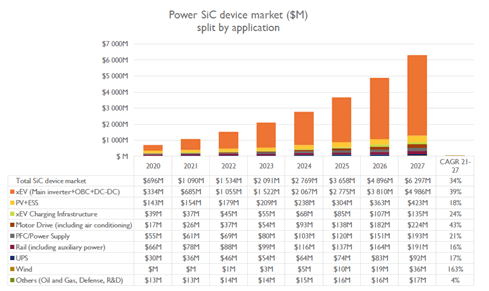

According to Yole Group’s “Power SiC 2022” report, the global SiC industry will reach US$6.3 billion in 2027, as shown in Figure 1, which breaks the market down by application. Let’s take a look at some of these end markets where SiC’s impact is being felt.

Figure 1. Power SiC device market ($M) split by application: 2021~2027 (Yole Group data)

EV/HEV

EVs and hybrid EVs (HEVs) are the main market drivers for SiC. Tesla, BYD, Hyundai, Weilai, Xiaopeng, GM and other automakers are introducing new models powered by SiC in the next five years.

The automotive market accounted for 63% of the overall SiC market in 2021. It’s estimated this will increase to 79% in 2027, with a market size close to US$5 billion. In the future, EVs will shift from 400 volts (V) to 800V. According to industry feedback, there is a lack of standardization for SiC components for the new 800V battery cars, making it very challenging for device manufacturers to address the needs of several OEMs simultaneously.

xEV charging infrastructure

The 800V battery system enables fast charging, and higher voltages are critical to shorten charging times while extending driving range by increasing battery capacity. Discrete components are used for <30kW chargers, while SiC modules are better suited for >50kW module charging. As of 2022, commercial high-power DC chargers can operate at 270 kilowatts (kW), and are expected to reach 350kW in the next few years. Moreover, various types of 1200V SiC components became available in 2022.

Solar photovoltaics and energy storage

As global renewable energy capacity continues to increase, it is expected that newly installed capacity will exceed 200 gigawatts (GW) in 2022. SiC diodes and transistors are used in hybrid or full SiC modules, mainly in 1200V rated devices, to provide higher power output and lower losses.

Electricity supply

As of 2022, server power applications mainly use SiC diodes and 650V SiC MOSFETs. With higher efficiency regulations from governments (for example, starting 2023 in Europe), SiC will be designated as the primary choice for high-power server power applications. In telecom, SiC adoption faces intense cost/performance competition from Si MOSFETs and is expected to compete with GaN in the medium to long term.

Rail transport

Uninterruptible power supplies (UPS)

The booming development of the Internet of things, artificial intelligence, big data, machine learning, video streaming and data centers has greatly increased the demand for UPS. As of 2022, hybrid SiC modules are still preferred over more costly full modules. The industry expects to deploy more all-SiC solutions in the next three to five years.

Wind power

The wind energy market remains cost competitive and still dependent on subsidies. Wind energy is a long-term market for SiC growth due to stringent requirements for reliability at high power and voltage levels. As of 2022, SiC penetration of this market remains limited.

Supply chain

Vertical integration of wafer fabrication and module packaging are two major trends reshaping the SiC supply chain. Integrated device manufacturers (IDMs) are the main business model for SiC, and industry leaders such as Wolfspeed, STMicroelectronics, ON Semiconductor, and ROHM have strong vertical momentum at the wafer-manufacturing level. They are integrated through mergers and acquisitions to ensure wafer supply in response to surging demand through 2022 and beyond. Internal 8-inch wafer manufacturing is the key resource to lower cost at the device level.

Wafer-capacity growth exceeds demand, but quantity does not equal quality. Wafer supply for high-volume applications such as EV inverters has been one of the major concerns over the past few years. Significant expansions in wafer capacity have been announced and implemented by many players. As of 2022, it is estimated that the announced SiC wafer production capacity is likely to exceed the demand of end systems, and this trend is expected to continue. The next challenge for wafer suppliers is to improve quality and production to obtain operational and cost competitiveness.

Technology

As of 2022, 6-inch SiC wafers are the mainstream. There was an initial volume of 8-inch wafers in 2022, used mainly for qualification of wafer quality, newly installed production lines, and tooling. A few vendors demonstrated 8-inch wafers, such as Wolfspeed, GTAT, II-VI, and SK Siltron CSS, while Wolfspeed, STMicroelectronics, ON Semiconductor, and ROHM are qualifying or demonstrating 8-inch platforms with internal wafer supplies.

Modules are the next major focus for SiC component makers, OEMs and tier 1 suppliers. Three component makers – STMicroelectronics, Infineon and ON Semiconductor – have automotive AQG324-qualified SiC modules in their portfolios as of 2022. Module packager companies such as Danfoss and Hitachi Energy can provide customized modules.

In the past few years, small size modules are one of the new trends in SiC. Tesla, for example, takes advantage of the higher power density characteristics of SiC. With the development towards 800V BEV, different power module packaging solutions are provided, such as sintered silver, substrate-less modules, copper bonding, silicon nitride ceramic substrates, or double-sided cooling. With that said, module power packaging has not yet been standardized.

Next up: GaN

Part II of this blog post will take a similar look at the key end markets for GaN, which include consumer, data communications, automotive and solar. Learn about GaN’s projected growth and the technology offers unique benefits for power-hungry applications in these vital markets and how they effect the compound semiconductor industry overall.